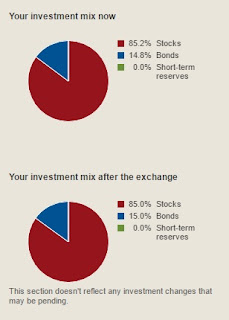

Not surprisingly, my Total International Stock Index Fund was way up! Overall, I am looking to increase my exposure to international markets, so I have been pursuing some changes to my asset allocation, which would significantly impact how I rebalance my account, but the discipline and philosophy of it would remain the exact same.

Not surprisingly, my Total International Stock Index Fund was way up! Overall, I am looking to increase my exposure to international markets, so I have been pursuing some changes to my asset allocation, which would significantly impact how I rebalance my account, but the discipline and philosophy of it would remain the exact same.In addition to my Total International Stock Index Fund, my Total Stock Market Index Fund and PRIMECAP Fund were up slightly (I had to move out significantly more from the actively-managed fund than the index fund, which may or may not mean anything for the future of the market). The pot was then evenly split between my Explorer Fund and my Total Bond Market Index Fund, except for a small portion falling into the High-Yield Corporate Fund (which I understand have been increasing in popularity, if not in value, quite a bit lately).

As I have said in the past, when I move my allocation targets, I make the decision at least one quarter before implementing those changes. Therefore, my next update might be the last one under my current asset allocation! If I decide to change my allocation, then the 1Q18 update should see a high infusion of assets into my Total International Stock Index Fund.

Which would make sense because there will be an important comparison at that point, which coincides with my blog's 9th anniversary fittingly. I look forward to sharing those results at that time!