I worked at Vanguard for 8 1/2 years. I have described their managerial style as "driving you insane, and then calling you crazy." Despite being away for over 7 years and counting, they still find ways to continue that methodology.

Last month, Vanguard made a decision for its 401(k) plan participants that baffled me greatly. It eliminated numerous funds from its line-up, including my Vanguard Explorer Fund and Vanguard High-Yield Bond Fund. Inexplicably, it moved the balance of those closed funds into their target retirement funds. I like target retirement funds. For my friends who do not care about investing or markets or rebalancing or any of this jazz, the target retirement funds are great! These funds handle that part for those people. They work great, *IF* that is the only fund in the account!

Mixing target retirement funds into an existing allocation would be incredibly complicated for tracking, and more importantly, generally unnecessary. Instead of investing in the target retirement fund, add the funds that make up the target retirement fund into your existing allocation. Which was how I handled this predicament here. The fact that Vanguard found it prudent to talk out of both sides of its proverbial mouth concerns me though, and I suspect that it may be only a matter of time before this behavior extends beyond its staff and begins to drive its customers crazy.

The target retirement fund consists of the Total Stock Market Index Fund (got it), Total International Stock Index Fund (got it), Total Bond Market Index Fund (got it), and Total International Bond Index Fund (need it). Therefore, I will introduce the Total International Bond Index Fund into my account and set its allocation based on the fact that it is both a bond fund and an international fund. For numerous years, I quietly held the Vanguard GNMA Fund, although its performance has not warranted special treatment. Now that I have been forced to rejigger my entire allocation, I will throw that fund out of the mix. It has been considered for years, alongside rising my international exposure.

Missing from this line-up is my precious PRIMECAP Fund, which I feel grateful that fund was retained in a small roster of so-called "supplemental investments." Their description of these alternative funds would be how most active investors would achieve their target allocation. In particular, my exposure to the Explorer Fund skewed my risk profile higher, and I was comfortable with that increased risk because I had a higher exposure to the bond markets simultaneously.

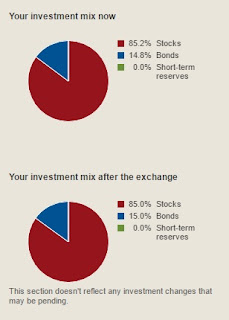

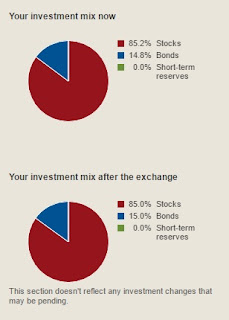

Therefore, I felt my prior allocation was more robust than the target retirement fund. Simple workaround though, I could take the existing target retirement fund's allocation and apply it to my account since there is enough carry over. However, I do not like its 60/40 split between domestic and international stocks. I would sooner have a 80/20 split, but I will split the difference and make mine a 70/30 split in both stocks and bonds (Vanguard has a 60/40 split in stocks but a 70/30 split in bonds).

My new allocation will have 30% allocated to both the Total Stock Market Index Fund and PRIMECAP Fund, 25% allocated to the Total International Stock Index Fund, 11% allocated to the Total Bond Market Index Fund, and the remaining 4% allocated to the new Total International Bond Index Fund (although I might later adjust the bond split to 10.5% and 4.5%, respectively to reflect a 70/30 split).

For the sake of interest, the other supplemental investments were Vanguard FTSE Social Index Fund, Vanguard International Growth Fund (any domestic growth/value counterparts are conspicuously absent), Vanguard Long-Term Investment-Grade Fund, Vanguard Retirement Savings Trust (in addition to Vanguard Prime Money Market Fund), Vanguard Short-Term Investment-Grade Fund, and three other balanced funds: Vanguard Wellesley Income Fund, Vanguard Wellington Fund, and Vanguard Windsor Fund. No mid- or small-cap funds, which concerns me slightly and perplexes me greatly.

I am not sure what Vanguard was thinking in this decision, especially considering its most loved fund (Vanguard Index 500 Fund) was completely excluded. Based on the number of lawsuits on 401(k) providers for having poor selection choices, making this move now could be inviting a lawsuit. I am certainly disappointed with Vanguard, but having worked there before, it is a familiar feeling.

Chorus

"On a good day, we can part the seas. On a bad day, glory is beyond our reach."

Thursday, August 9, 2018

Tuesday, July 3, 2018

The Full Motley -- 2Q, 2018

Happy Independence Day!! Time for a quarterly update, as delayed as it may be. Although we just moved into the third quarter, I rebalanced on my usual May 10th date (but it has been a busy year on other projects, so I did not draft a correlated blog entry timely). Considering financial independence is the ultimate goal of personal investing, an update falling on Independence Day feels somewhat fitting!

During the past week, I heard a discussion on 1510 Money Radio about leaving money with a former-employer's 401(k) plan or moving it, and I tried to think of a single benefit for leaving it. There is far more control and flexibility in an IRA than in an employer's 401(k) plan, so by large, the benefits were to move the assets or, at least, it was a neutral impact to leave the money alone. The only scenario I could say was a benefit to leaving assets in a former-employer's plan (and the reason I had left my assets inside mine) was if the expense ratios were significantly less inside the employer's plan than in an individual investment. Strength in numbers.

I am not gaining much, necessarily, by leaving it with my old employer, but like I said, moving it into a rollover IRA would not have much more flexibility or control, so I strategically opted to leave it where it was.

Unfortunately, I have learned that Vanguard just limited its investment options allowed in its 401(k) plan, nixing two of the five funds into which I have been directing my assets for the past 10 years. Therefore, it may be time to roll my assets into an IRA to continue my current asset allocation. The flexibility is now better in a rollover IRA.

In the wake of numerous legal cases against employers offering limited selections and providing self-serving options in its employer-sponsored plans, this was a peculiar timing by Vanguard. They have conditioned their investors to utilize asset allocations and rebalancing for the past 40 years, so it is counter-intuitive that they would remove numerous sector funds that complete an independent allocation. For those 12 funds, the money was directed into their target retirement suite.

While these all-in-one funds are superb investments for novice investors who want to put all their assets into a single fund throughout their investing lifetime, target retirement funds should not be held in a robust portfolio with other investments, except as an intentional, strategic play (and even then, I would expect active investors to buy the index funds that the target retirement funds use directly). At best, the timing is peculiar. At worst, it was ill-fated. I would not be surprised to see this power-play backfire on Vanguard, which has had a handful of lawsuits in recent years (with very mixed results). Considering the benefits are two-fold for Vanguard: first, it forcibly increases the AUM in their target retirement suite, which is a highly competitive field in the industry right now, and secondly, and more damning, the expense ratio in the target retirement funds are higher than in at least some of the options that they have ceased offering. This move would cost investors more money in the long run, which is a legitimate basis for a legal complaint.

During the past week, I heard a discussion on 1510 Money Radio about leaving money with a former-employer's 401(k) plan or moving it, and I tried to think of a single benefit for leaving it. There is far more control and flexibility in an IRA than in an employer's 401(k) plan, so by large, the benefits were to move the assets or, at least, it was a neutral impact to leave the money alone. The only scenario I could say was a benefit to leaving assets in a former-employer's plan (and the reason I had left my assets inside mine) was if the expense ratios were significantly less inside the employer's plan than in an individual investment. Strength in numbers.

I am not gaining much, necessarily, by leaving it with my old employer, but like I said, moving it into a rollover IRA would not have much more flexibility or control, so I strategically opted to leave it where it was.

Unfortunately, I have learned that Vanguard just limited its investment options allowed in its 401(k) plan, nixing two of the five funds into which I have been directing my assets for the past 10 years. Therefore, it may be time to roll my assets into an IRA to continue my current asset allocation. The flexibility is now better in a rollover IRA.

In the wake of numerous legal cases against employers offering limited selections and providing self-serving options in its employer-sponsored plans, this was a peculiar timing by Vanguard. They have conditioned their investors to utilize asset allocations and rebalancing for the past 40 years, so it is counter-intuitive that they would remove numerous sector funds that complete an independent allocation. For those 12 funds, the money was directed into their target retirement suite.

While these all-in-one funds are superb investments for novice investors who want to put all their assets into a single fund throughout their investing lifetime, target retirement funds should not be held in a robust portfolio with other investments, except as an intentional, strategic play (and even then, I would expect active investors to buy the index funds that the target retirement funds use directly). At best, the timing is peculiar. At worst, it was ill-fated. I would not be surprised to see this power-play backfire on Vanguard, which has had a handful of lawsuits in recent years (with very mixed results). Considering the benefits are two-fold for Vanguard: first, it forcibly increases the AUM in their target retirement suite, which is a highly competitive field in the industry right now, and secondly, and more damning, the expense ratio in the target retirement funds are higher than in at least some of the options that they have ceased offering. This move would cost investors more money in the long run, which is a legitimate basis for a legal complaint.

Friday, February 9, 2018

The Full Motley -- 1Q, 2018

I have been looking forward to this update for quite some time for two major reasons! First, today is the ninth anniversary of my blog. Back in 2009, I doubled the percent of my income going into my 401(k) because the market had fallen so low and I wanted to put more money in when the market was downtrodden. My expectations, best as I recall, was that it would take years for the market to turn around, so I wanted to track my mentality as I expected the recovery would test my mental mettle as I put money into an account, only to see it fall further and further. As luck would have it, this decision was made exactly one month before the end of the bear market and it was an abnormally long upward trend since that time. Of course, that stretch may be nearing an end -- but I will address that later.

The other reason I have been looking forward to this post is that I have now been at my current job for about half of the time that I was employed at Vanguard. Based on common sense alone, my balance at Vanguard should be twice as large as that at my current employer. In that regard, it is no surprise that the balance is double. Based on everything we know compounding interest, it should be no surprise that the balance is in fact more than twice as large as my current balance. The fact that my balance is more than triple the balance of my active 401(k) balance provides minimal shock.

However, the part that astounds me are the following factors:

By all accounts, the amount that I have put into my active 401(k) is considerably higher than the amount of my own money that went into my Vanguard account. The fact that my Vanguard balance is more than triple than the balance in my active 401(k) supports the power of compound interest. Even if I divided my present Vanguard balance in half, then that amount is still another 60% higher than my active 401(k) balance.

All these numbers and calculations support the simple belief that "time is money," and between the two, time is far more valuable. Unfortunately, both are non-renewable resources. While money can be used to generate more money, time cannot find you more time. Therefore, time is the most valuable resource we have. Likewise, everyone is given the same 24 hours in a day. In that regard, time is the most just resource.

Unfortunately, "timing" the market is not the best route to go. Perhaps if someone knew exactly what direction the markets were headed at any given time, then it would be a different story. But because there is no way to know for certainty what today's market will do tomorrow, much less a year or two from now. But if you were to predict whether the market would be higher or lower in the next decade, the good money bet has always been on higher. That is the basis behind investing, as well as indexing and all the other concepts that I have discussed for the past decade on this blog myself.

The other reason I have been looking forward to this post is that I have now been at my current job for about half of the time that I was employed at Vanguard. Based on common sense alone, my balance at Vanguard should be twice as large as that at my current employer. In that regard, it is no surprise that the balance is double. Based on everything we know compounding interest, it should be no surprise that the balance is in fact more than twice as large as my current balance. The fact that my balance is more than triple the balance of my active 401(k) balance provides minimal shock.

However, the part that astounds me are the following factors:

- When I doubled my payroll deductions, I went from putting just enough to maximize my employer match to double that percentage (this amount only lasted for two years).

- When I started at my new job, I started at more than 20% higher than my highest income at Vanguard (it is currently 45% now).

- At my new employer, I have been withholding the same amount that I had been withholding, which was still double the employer match.

By all accounts, the amount that I have put into my active 401(k) is considerably higher than the amount of my own money that went into my Vanguard account. The fact that my Vanguard balance is more than triple than the balance in my active 401(k) supports the power of compound interest. Even if I divided my present Vanguard balance in half, then that amount is still another 60% higher than my active 401(k) balance.

All these numbers and calculations support the simple belief that "time is money," and between the two, time is far more valuable. Unfortunately, both are non-renewable resources. While money can be used to generate more money, time cannot find you more time. Therefore, time is the most valuable resource we have. Likewise, everyone is given the same 24 hours in a day. In that regard, time is the most just resource.

Unfortunately, "timing" the market is not the best route to go. Perhaps if someone knew exactly what direction the markets were headed at any given time, then it would be a different story. But because there is no way to know for certainty what today's market will do tomorrow, much less a year or two from now. But if you were to predict whether the market would be higher or lower in the next decade, the good money bet has always been on higher. That is the basis behind investing, as well as indexing and all the other concepts that I have discussed for the past decade on this blog myself.

Thursday, November 16, 2017

The Full Motley -- 4Q, 2017

The domestic markets continue to rise, surpassing 23,500 at the beginning of this month. If the customary "Santa Claus Rally" occurs again this year, it may be enough to push the Dow above 25,000 by the end of the year. Of course, the last quarter is only half-finished, so there is plenty of time for the markets to retreat as well. Not to mention, same as the unflappable credo of every disappointed sports fan: "There's always next year!"

A market retreat is inevitable in every way, except its timing. Whether people decide that they have enough and now want to preserve it or if enough people uniformly time the market before a retreat to create what they fear remains to be seen. Based on the rise the market has enjoyed for the past 10 years, it could be a furious decline! Although 2008-09 decline was always characterized as a "once-in-a-lifetime" opportunity, I think many people do not believe it. Many are still on guard for another 50% retreat and playing both sides of the fence. Some are invested in cash because they expect the markets to plummet again and others are invested in cash because they want funds available to invest when the market declines.

When I re-balanced last week, there was one thing more clear than everything else: active investing had far surpassed index investing. As it turned out, that is not my imagination or limited to my own profile. CNBC had even posted an article about it at the end of last quarter.

Because I am equally invested in Vanguard Total Stock Market Index Fund and Vanguard PRIMECAP Fund, the impact did not affect me much. But when I introduced the actively managed fund to my portfolio, I had indicated that if it trailed the index fund for two consecutive quarters that I would move that money back to the index. As it turned out, the index fund did outpace my active fund for two consecutive quarters and I strongly considered moving it back to the index fund. However, I knew there could be a time and day when market conditions favored active investing. It has been boasted for years, but this is the first time that I remember seeing a significant difference between the two.

Apparently, that time is now.

-------

I think one indicator of a slowing (is active surpassing the index) (also WFS and Equifax not being punished for their criminal activities)

[euphoria]

A market retreat is inevitable in every way, except its timing. Whether people decide that they have enough and now want to preserve it or if enough people uniformly time the market before a retreat to create what they fear remains to be seen. Based on the rise the market has enjoyed for the past 10 years, it could be a furious decline! Although 2008-09 decline was always characterized as a "once-in-a-lifetime" opportunity, I think many people do not believe it. Many are still on guard for another 50% retreat and playing both sides of the fence. Some are invested in cash because they expect the markets to plummet again and others are invested in cash because they want funds available to invest when the market declines.

When I re-balanced last week, there was one thing more clear than everything else: active investing had far surpassed index investing. As it turned out, that is not my imagination or limited to my own profile. CNBC had even posted an article about it at the end of last quarter.

Because I am equally invested in Vanguard Total Stock Market Index Fund and Vanguard PRIMECAP Fund, the impact did not affect me much. But when I introduced the actively managed fund to my portfolio, I had indicated that if it trailed the index fund for two consecutive quarters that I would move that money back to the index. As it turned out, the index fund did outpace my active fund for two consecutive quarters and I strongly considered moving it back to the index fund. However, I knew there could be a time and day when market conditions favored active investing. It has been boasted for years, but this is the first time that I remember seeing a significant difference between the two.

Apparently, that time is now.

-------

I think one indicator of a slowing (is active surpassing the index) (also WFS and Equifax not being punished for their criminal activities)

[euphoria]

Monday, September 18, 2017

Active Outpacing Passive Investing (Reprint)

The Tide Has Turned: Active Outpacing Passive Investing

In the perennial race between active and passive investment management, there are signs of a shift. After several years of bringing up the rear, active performance has outpaced passive so far in 2017. Various factors suggest that it could stay out front for a few years.

This year has been the best for active fund performance since the bull market began, as it has bested passive more than half the time. About 54 percent of active managers have beaten their benchmarks overall so far in 2017; about 60 percent did so in July.

Meanwhile, though long-depressed inflows into active funds have shown new life recently (they had their best week in 30 months in July, taking in $3.5 billion), money keeps gushing into exchange-traded funds. (Vanguard investors in index funds and ETFs now own nearly 5 percent of the S&P 500.) Real dominance by active management would be marked by a reversal of this tide.

This won't happen, of course, until after active management has shown a sustained performance advantage.

Various considerations suggest the potential for this, including:

Past trends. Historically, active management's comebacks have been multiyear rather than single-year. Though passive has reigned supreme over the past six years, active won the race for six years in the 1990s and from 2001 to 2011. Just as passive management has done best in up markets, active's potential for superior performance tends to be higher in difficult markets. Thus, active did well in the difficult market of the mid-1990s, and passive took the lead during the tech boom late in that decade.

Today's narrow bull market. When the bull's starting point is pegged to the ascent that followed the financial crisis of 2008, the current bull market is now nine years old, the longest since World War II (though the argument could be made that this bull is actually of shorter duration because the market didn't hit a new high until 2013). Regardless, those anticipating a new market cycle are more likely to be gratified with each passing month, as the price/earnings ratio of dominant names have risen to ethereal heights.

This market has a weakness that isn't acknowledged widely enough: It's being driven mainly by six large-cap stocks — Facebook, Apple, Amazon, Microsoft, Google and Johnson & Johnson (the Big Six.) When the market has gone up in the past couple years, much of the gain has been because one or more of these stocks has appreciated. As of early September, year to date, all of the stocks have had robust double-digit gains, with Facebook's shares appreciating nearly 48 percent and Apple's about 37 percent.

If these few bulls stop running and the herd doesn't find new leaders, this result could be an ensuing difficult market — the kind where active managers do best.

Increasing opportunities for contrarian managers. With huge investment from index funds and ETFs, the Big Six have amassed a collective market capitalization of $3.4 trillion — greater than the total value of the bottom 1,115 stocks in the S&P 1,500 — the lower large-cap companies. If the Big Six falter, money pouring into them will presumably find other places to go.

But even if this happens, empowering the bull market to continue, passive management's fixation on the S&P 500 will continue to provide increased opportunities for active managers seeking value opportunities among lower large-cap companies. And some of these 1,115 orphans are fairly attractive.

Labels:

CNNFN

Saturday, August 12, 2017

The Full Motley -- 3Q, 2017

We passed through the first six months of 2017 without any major incidents affecting the stock market as the Dow soared up past 22,000, before falling a little this week. But true to the cliche, "what goes up must come down." Granted, those who have bought & held that philosophy since 2008 might disagree as the market's 2009 low-water mark may not be seen again. Someday, I will discuss the term "financial gravity" in relation to personal investing, but for now, I need to re-balance my 401(k), which I did on Tuesday, a day ahead of my usual target date of the 10th.

Not surprisingly, my Total International Stock Index Fund was way up! Overall, I am looking to increase my exposure to international markets, so I have been pursuing some changes to my asset allocation, which would significantly impact how I rebalance my account, but the discipline and philosophy of it would remain the exact same.

Not surprisingly, my Total International Stock Index Fund was way up! Overall, I am looking to increase my exposure to international markets, so I have been pursuing some changes to my asset allocation, which would significantly impact how I rebalance my account, but the discipline and philosophy of it would remain the exact same.

In addition to my Total International Stock Index Fund, my Total Stock Market Index Fund and PRIMECAP Fund were up slightly (I had to move out significantly more from the actively-managed fund than the index fund, which may or may not mean anything for the future of the market). The pot was then evenly split between my Explorer Fund and my Total Bond Market Index Fund, except for a small portion falling into the High-Yield Corporate Fund (which I understand have been increasing in popularity, if not in value, quite a bit lately).

As I have said in the past, when I move my allocation targets, I make the decision at least one quarter before implementing those changes. Therefore, my next update might be the last one under my current asset allocation! If I decide to change my allocation, then the 1Q18 update should see a high infusion of assets into my Total International Stock Index Fund.

Which would make sense because there will be an important comparison at that point, which coincides with my blog's 9th anniversary fittingly. I look forward to sharing those results at that time!

Not surprisingly, my Total International Stock Index Fund was way up! Overall, I am looking to increase my exposure to international markets, so I have been pursuing some changes to my asset allocation, which would significantly impact how I rebalance my account, but the discipline and philosophy of it would remain the exact same.

Not surprisingly, my Total International Stock Index Fund was way up! Overall, I am looking to increase my exposure to international markets, so I have been pursuing some changes to my asset allocation, which would significantly impact how I rebalance my account, but the discipline and philosophy of it would remain the exact same.In addition to my Total International Stock Index Fund, my Total Stock Market Index Fund and PRIMECAP Fund were up slightly (I had to move out significantly more from the actively-managed fund than the index fund, which may or may not mean anything for the future of the market). The pot was then evenly split between my Explorer Fund and my Total Bond Market Index Fund, except for a small portion falling into the High-Yield Corporate Fund (which I understand have been increasing in popularity, if not in value, quite a bit lately).

As I have said in the past, when I move my allocation targets, I make the decision at least one quarter before implementing those changes. Therefore, my next update might be the last one under my current asset allocation! If I decide to change my allocation, then the 1Q18 update should see a high infusion of assets into my Total International Stock Index Fund.

Which would make sense because there will be an important comparison at that point, which coincides with my blog's 9th anniversary fittingly. I look forward to sharing those results at that time!

Saturday, July 1, 2017

The Dow, the Nasdaq, and the S&P 500 (Reprint)

What's the Difference Between the Dow, the Nasdaq, and the S&P 500?

Turn on the news and you'll see these three stock market indices. Here's the difference between them and why it matters.

Jay Jenkins (TMFJayHJenkins)

Jul 8, 2014 at 1:00 p.m.

"The Dow Jones Industrial Average (DJINDICES:^DJI) was down 0.74% as of 1:05 p.m. EDT, falling back under the 17,000 mark. The S&P 500 (SNPINDEX:^GSPC)was down just slightly more, while the Nasdaq (NASDAQINDEX:^IXIC) plummeted by 1.5%."

Days like (this) can leave beginning investors confused by the mechanics of the markets. How bad is the market? Is it 0.7% bad like the Dow or S&P, or is it twice that bad as we see in the Nasdaq?

To understand exactly what's happening in the market today, let's break down each of these major indices and drill down into why each is different and also somewhat the same.

The Dow Jones

The Dow Jones Industrial Average is the oldest, best known, and most followed of the major stock market indices. It is comprised solely of 30 large-cap companies. These companies represent a huge array of American business -- from consumer facing to business-to-business, tech to manufacturing, domestic to international, and everything in between.

Two concepts make the Dow so popular. First, the companies in the index are huge, and taken together they legitimately represent a huge swath of the U.S. economy. So while there are thousands of publicly traded companies, these big boys are sufficiently large to effectively act as a proxy for all the other enterprises.

Second, the Dow components are nearly universally recognized household names. With the likes of Coca Cola (NYSE:KO), McDonald's, or IBM, investors know that these companies are the real deal, with the size, scale, and presence in the economy to accurately stand as a proxy for the overall markets.

The Dow does have a quirk, a remnant of its history of more than a century. The index is price-weighted, meaning that companies with a higher share price have a larger impact on the Dow's movements. That's why Visa (NYSE:V)has an 8.1% weight versus just 1.59% for Coke.

The S&P 500

The S&P 500 takes a slightly different approach to represent the movements of the broader markets. The index covers the largest companies that trade on the New York Stock Exchange or Nasdaq Stock Market, weighted by market cap.

The S&P 500 chooses component companies based on a few basic criteria. The stock must trade at sufficient volume with adequate market liquidity. The company's market cap must be above $5 billion. At least 50% of the company's stock must be part of the public float.

The S&P also attempts to mirror the diversity of the largest companies on the NYSE and Nasdaq; if 10% of the largest companies are in manufacturing, then the S&P will attempt to maintain 10% of the index in manufacturing companies.

There are two other obvious yet notable contrasts with the Dow. First, there's the number of component stocks, 30 versus 500. The S&P is a much broader measure of the markets and captures a greater percentage of the U.S. economy. That said, the lower you move in market cap, the less impact those stocks have on the index as a whole. So in many instances, the Dow and the S&P track each other very closely.

Second, unlike the Dow, the S&P is not price-weighted. Instead, it weights its component companies by the actual size of the company in the market. This eliminates some of the odd Dow pricing when a stock with a high stock price but relatively lower market cap makes a large movement in either direction.

Both of these differences creates a smoothing effect on the S&P -- it's just not as volatile as the Dow.

The Nasdaq

First, let's clarify exactly what we're talking about here. The Nasdaq (NASDAQ:NDAQ) is a stock exchange, similar to the New York Stock Exchange. It was, in fact, the first all-electronic stock exchange. That is not what we're here to discuss.

We're talking about the Nasdaq Composite, another market proxy based on certain stocks being publicly traded. The Nasdaq Composite is based on the 4,000+ stocks being traded on the Nasdaq Stock Market. The difference is subtle, but it's worth understanding to avoid any confusion.

Generally, the Nasdaq Composite is a good proxy for what is happening in the tech segments of the markets. The vast majority of the companies trading on the exchange are tech, which leads to this generalization.

That said, there are certainly a respectable number of companies from a broad range of industries also traded on the Nasdaq Composite -- from banks to airlines to coffee shops. But these nontech components remain a small contingent in this index.

Like the S&P, the Nasdaq is weighted by market cap, thus avoiding some of the odd pricing situations seen with the Dow.

So which way is the market heading?

When I see the headlines at the end of the day's trading, I tend to gravitate to the S&P 500. To me, the 500 component stocks weighted by market cap is the best representation of the broad market movements.

If you're interested in tech, then you may have more interest in the Nasdaq. Just know that you're not looking at the market in a broad sense with that index, you're looking disproportionately at the tech segment.

The Dow, of course, is and will remain the primary index used in the news and by most public market commentators. It's the oldest, it's the best known, and in truth it's good enough to serve in that role. But, as a Foolish investor, always keep in the back of your mind that it has just 30 stocks and it's calculated with that oddball price-weighted system.

Subscribe to:

Posts (Atom)